Development Zones

5% Income Tax on Manufacturing Activities

0% Income Tax on Exported Services

Jordan's Development Zones: Investment Benefits & Incentives

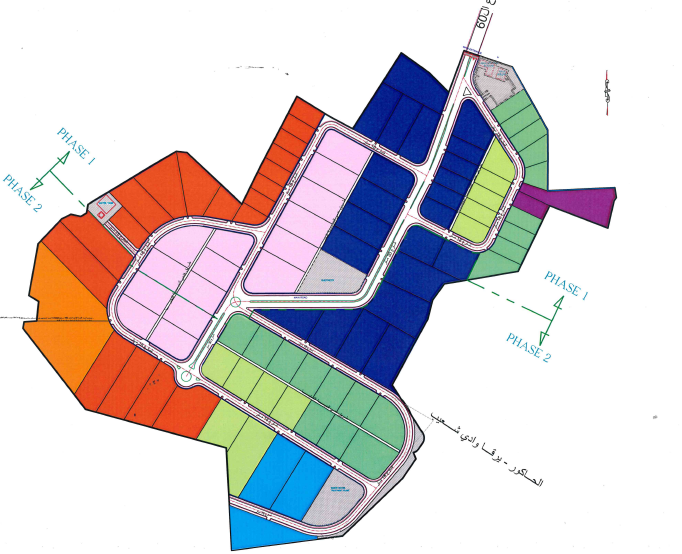

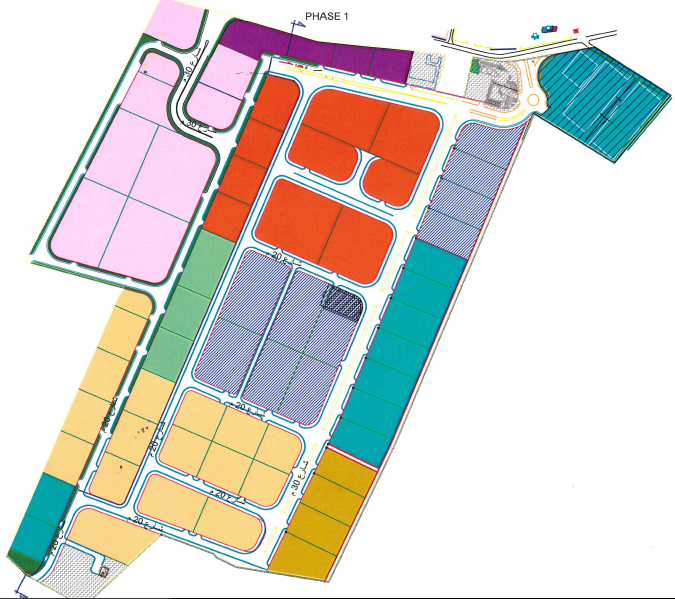

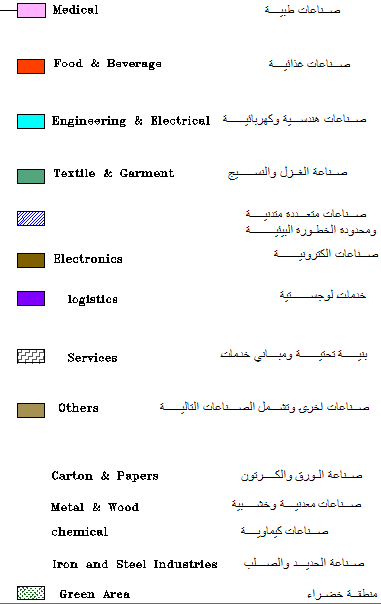

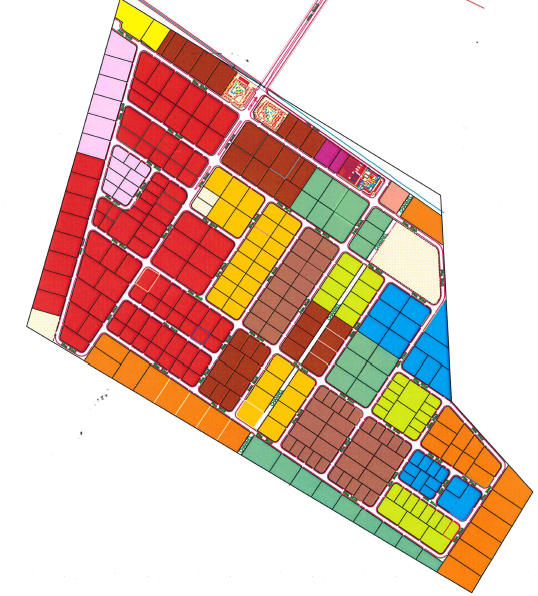

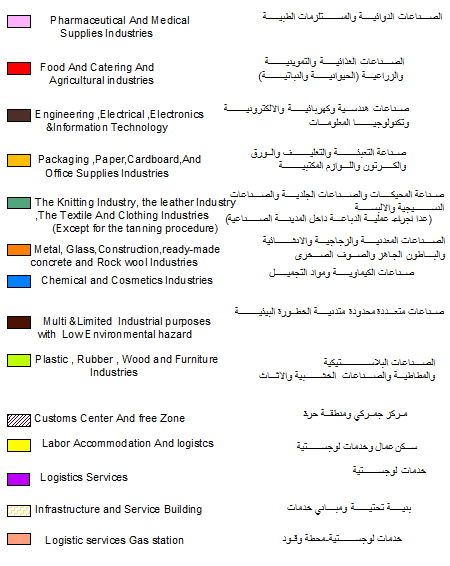

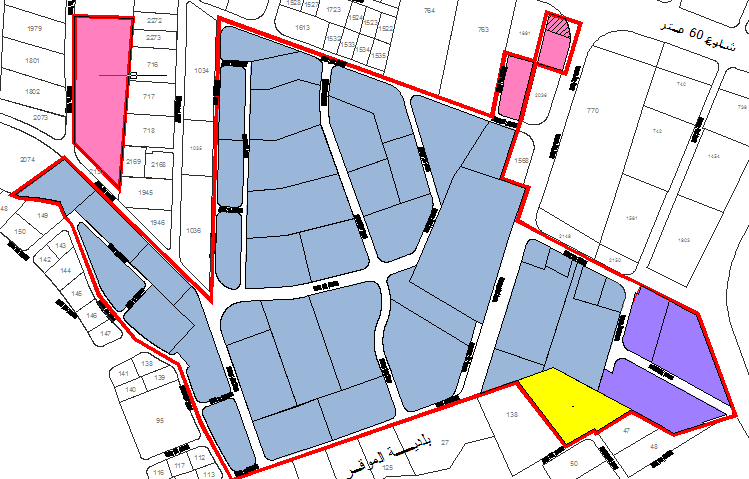

The ministry regulates the work of development zones throughout the Kingdom. They are dedicated to various fields of business and industry and are equipped with the investor’s needs of infrastructure and services. These areas are managed by development companies that work to develop the infrastructure and facilitate the work of investors. Development zones aim to distribute the gains from economic development and create job opportunities by creating a competitive advantage based on specialization and providing an integrated system of services to investors that support the growth and development of enterprises.

5% income Tax for manufacturing companies operating within the Development Zones, and 10% income Tax for all other registered entities.

Benefits and Incentives for Registered Enterprises in Development Zones

Exemption from Local Municipality Charges

Exemption from paving, organization, improvement charges, license fees, and building and land taxes without prejudice to acquired rights.

Tax Exemptions for Exported Services

Benefit from tax exemptions in force related to export of services outside the Kingdom.

Standard Income Tax on Other Economic Activities

5% income tax on income from manufacturing industrial activities with at least 30% local added value

Preferential Income Tax for Industrial Manufacturing

5% income tax on income from manufacturing industrial activities with at least 30% local added value

Customs Duty Exemption

Exemption from customs duties on materials, equipment, machinery, fixtures, construction materials, spare parts, and goods imported into or exported from the Zone (excluding export duties, service charges, and applicable fees).

Local Market Exemptions for Jordan-Origin Goods

Goods produced or manufactured in the Zone that meet Jordanian origin requirements are exempt from customs duties and other taxes or fees when placed in the local market.

Zero-Rate Sales Tax on Economic Activity Inputs

Goods and services purchased or imported for conducting Economic Activity in the Zone are subject to general sales tax at the zero rate (0%).

Sales Tax Exemption on Worker Transport Vehicles

Handling and transportation vehicles (10+ persons including driver), sold to a Registered Establishment for transporting workers, are exempt from general sales tax (as per regulation).

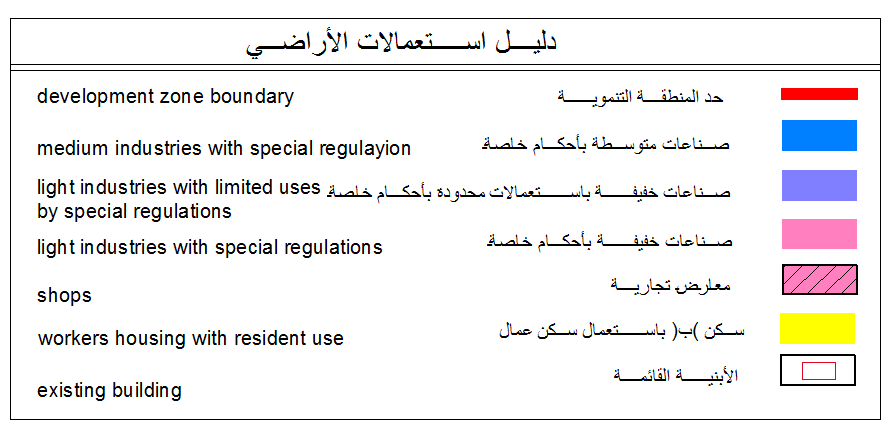

Income tax on the institutions registered in developmental zones

The tax on the enterprise registered in the developmental zones arising from the activities of the licensed manufacturing industries in these zones where the local added value is not less than (30%) is at the rate of (5%).

Income tax shall be at a rate of (10%) of the taxable income of the registered enterprises in the development zone for the rest of its activities and projects.

Economic Activity Licensing in Development Zones

The Ministry of Investment is responsible for issuing electronic licenses for practicing economic activity within the development zones. This license serves as an official and recognized professional license.

Investors can submit their applications for obtaining the economic activity license within the development zones conveniently through the electronic services available on the Ministry of Investment’s website.

To access the Ministry of Investment’s electronic services portal, click here:

https://portal.moin.gov.jo/Investment/LoginPage